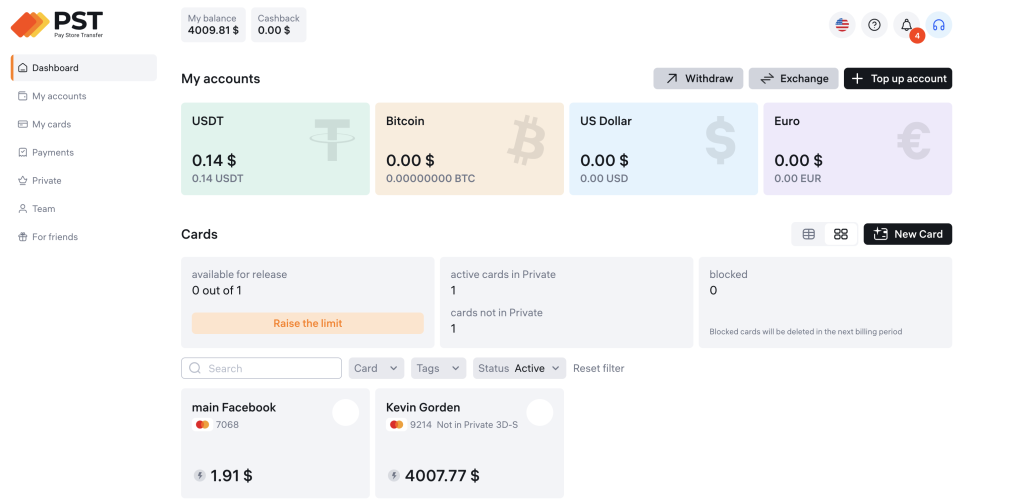

Generate Unlimited Crypto Virtual Credit Cards

PST is a Game-Changer

In the fast-paced world of digital advertising and online transactions, having a reliable and flexible payment system is crucial. Whether you’re running Facebook ad campaigns, managing multiple online businesses, or simply looking for a hassle-free way to handle transactions, PST cards is a revolutionary solution you need to know about. With its unlimited virtual cards and seamless integration with cryptocurrencies, PST offers unparalleled convenience and control over your online payments.

What is PST?

PST is a cutting-edge crypto financial service that provides unlimited virtual cards designed for online transactions. The system is specifically tailored for businesses, marketers, and entrepreneurs who need a seamless and scalable payment solution. Unlike traditional banks, which often impose limits and restrictions, PST gives you the freedom to generate as many virtual cards as needed—instantly and effortlessly.

The Power of Unlimited Virtual Cards

One of the standout features of PST is the ability to create unlimited virtual cards. Here’s why this is a game-changer:

- Perfect for Ads and Online purchases – If you’ve ever run ad campaigns, you know how frustrating it can be when your payment methods get flagged or declined. With PST, you can generate multiple virtual cards, ensuring uninterrupted ad spending and smoother campaign management.

- Better Budget Control – Assign specific budgets to each card, preventing overspending and keeping ad expenses under control.

- Improved Security – By using unique virtual cards for different platforms, you minimize the risk of fraud and unauthorized transactions.

- Seamless Integration with Multiple Platforms – Whether you’re paying for Google Ads, TikTok Ads, or any other digital marketing service, PST’s virtual cards are accepted almost everywhere.

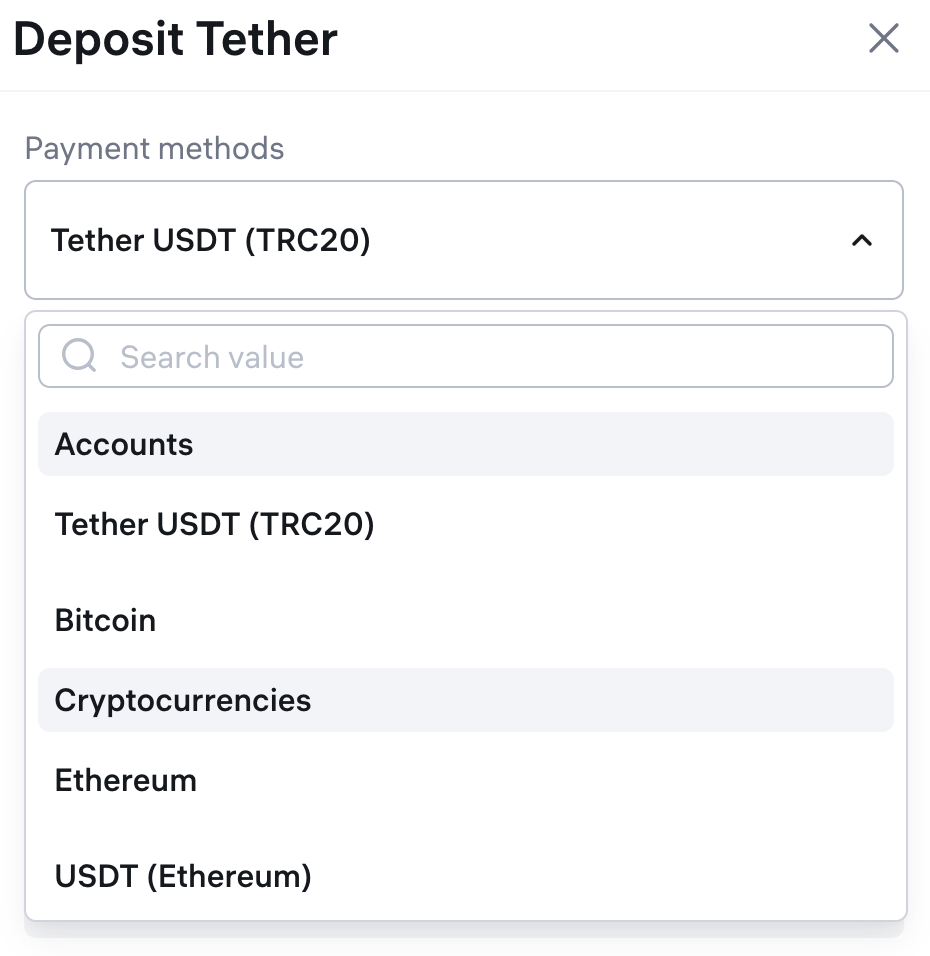

Crypto-Powered Transactions

Another major advantage of PST is its integration with cryptocurrencies. This means you can fund your virtual cards using crypto assets, allowing for:

- Fast and Borderless Transactions – No need to deal with banking delays or restrictions.

- No Banking Hassles – Avoid the typical verification issues and limitations of traditional banks.

- Privacy and Control – With crypto funding, your transactions remain private, and you have full control over your funds without intermediaries.

Why Choose PST Over Traditional Banking?

Traditional banks often impose limits, unnecessary paperwork, and restrictions on digital entrepreneurs and advertisers. Here’s how PST outshines traditional banking:

| Feature | Traditional Banks | PST |

|---|---|---|

| Virtual Cards | Limited | Unlimited |

| Crypto Funding | Rarely Supported | Fully Integrated |

| Approval Process | Slow & Complex | Fast & Easy |

| Ad Payments | Often Restricted | Fully Accepted |

| Spending Control | Hard to Manage | Highly Customizable |

With PST, you can say goodbye to declined transactions, unnecessary delays, and the headache of dealing with rigid banking policies. Instead, enjoy a seamless experience that adapts to your needs.

How to Get Started with PST.net

Getting started with PST.net is simple and straightforward:

- Sign Up – Visit PST and create an account.

- Verify Your Identity – A quick verification process ensures security and compliance.

- Fund Your Account – Use crypto or other available funding methods to top up your balance.

- Generate Virtual Cards – Create unlimited virtual cards instantly and start using them for your online transactions.

- Enjoy Hassle-Free Payments – Use your virtual cards for Facebook ads, e-commerce, subscriptions, and more without limitations.

Final Thoughts

If you’re an advertiser, e-commerce entrepreneur, or anyone who frequently makes online transactions, PST is a must-have tool. The ability to create unlimited virtual cards, combined with the power of crypto funding, makes it the perfect solution for those who demand flexibility, security, and reliability in their payments.

Say goodbye to banking restrictions and hello to unlimited possibilities with PST! Try it today and experience the future of digital payments.